Tariff Overview - Tax Incentives | Indonesia Tax Guide 2025 (24)

Indonesia

Tariffs

Tax incentives

2025-02-19 09:10:19

Page view:3875

This issue's introduction

Tax Benefits

Chapter V Tariffs

Overview

According to the Ministry of Finance Regulation No. 96 of 2023, e-commerce traders who import more than 1,000 batches of goods each year are required to exchange data with the customs department.

Tax Benefits

(1) Government projects funded by foreign loans and grants

Government projects funded by foreign loans or grants can enjoy special tax incentives for the income generated by their loans or grants. Government projects with the above qualifications are clearly specified in the National Project List (Daftar Isian Proyek, referred to as "DIP") or other similar documents. The taxable income tax of general contractors, consulting companies and suppliers of government projects funded by foreign loans or grants can be borne by the government. This tax incentive does not apply to sub-contractors, consulting companies and suppliers.

In addition to the above tax incentives, general contractors, consulting companies and suppliers of government projects funded by foreign loans or grants can also enjoy the following tax incentives when importing goods and using foreign taxable services or foreign intangible goods for the project:

① Exemption from import tariffs;

② Exemption from value-added tax and luxury goods sales tax;

③ Exemption from income tax at the time of import.

If part of the funds for eligible government projects are foreign loans or grants, only that part will enjoy tax incentives.

(2) Integrated Economic Development Zone (KAPET)

There are several integrated economic development zones in Indonesia. Enterprises engaged in business activities in KAPET can enjoy tax incentives. The designated areas of KAPET are clearly stipulated in the relevant presidential decree. Enterprises located in the KAPET bonded area (Pengusaha DiKawasan Berikat, referred to as "PDKB") can apply for the following forms of tax incentives:

① Income tax incentives, which are similar to the above-mentioned inbound investment tax incentives;

② Exemption from VAT and luxury sales tax when importing specific goods;

③ Exemption from income tax when importing specific goods;

④ Deferral of customs duties on imported capital goods, equipment, goods and raw materials for processing

⑤ Exemption from VAT and luxury sales tax when purchasing specific goods locally.

(3) Bonded Storage Area (Tempat Penimbunan Berikat, referred to as "TPB")

Bonded storage areas currently include:

① Bonded area;

② Bonded warehouse;

③ Bonded exhibition area;

④ Duty-free shop;

⑤ Bonded auction area;

⑥ Bonded recycling area;

⑦ Bonded logistics center.

Taxpayers in the above areas can enjoy the following tax incentives:

① Exemption from income tax when importing specific goods;

② Deferred payment of import tariffs on specific goods;

③ Exemption from consumption tax on imported specific goods;

④ Exemption from value-added tax and luxury goods sales tax when purchasing specific goods locally.

(4) Free Trade Zone (Free Trade Zone, hereinafter referred to as "FIZ")

Goods entering FTZ and delivered between enterprises in FTZ can enjoy tax incentives. Taxpayers located in FTZs can enjoy the following tax incentives:

①Exemption from VAT and luxury sales tax when importing certain goods;

②Exemption from Indonesian income tax when importing certain goods;

③Exemption from import duties on certain goods:

④Exemption from consumption tax when importing certain goods;

⑤Exemption from VAT and luxury sales tax when purchasing certain local goods;

⑥Except for sales to other companies in Indonesia and in bonded storage areas or special economic zones, transactions of intangible goods and taxable services are exempt from VAT.

(5) Special Economic Zones (Kawasan Ekonomi Khusus, hereinafter referred to as "KEK")

Taxpayers who carry out production and business operations in special economic zones can enjoy tax incentives. Business activities must cover the main business activities designated by each KEK. The areas of KEK are clearly defined by government regulations. Taxpayers in KEKs can enjoy a 10-20 year tax exemption based on their investment amount. After the tax exemption period, they can continue to enjoy a two-year reduction in corporate income tax.

Taxpayers whose applications for corporate income tax exemptions are rejected and taxpayers engaged in other production and business in KEKs can apply for tax allowances similar to those under income tax incentives. In addition to the above-mentioned income tax incentives, taxpayers in KEKs also enjoy the following tax incentives:

① Exemption from VAT and luxury sales tax on the import of certain goods;

② Exemption from income tax on the import of certain goods;

③ Deferral of customs duties on capital goods, equipment, goods and raw materials used for processing;

④ Exemption from consumption tax on imported goods used to produce non-consumption taxable items;

⑤ Exemption from VAT and luxury sales tax on local purchases of certain goods.

(6) Industrial Zones (Kawasan Industri, referred to as "KI")

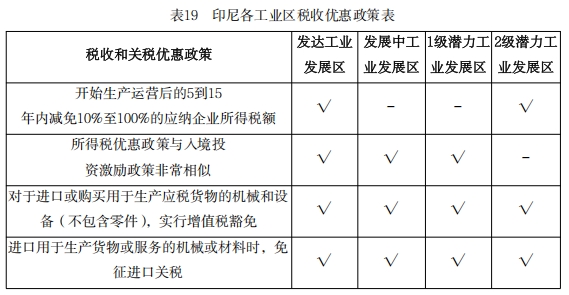

The recognition and licensing of industrial zones are regulated by the government. The tax incentives that companies can apply for depend on the classification of industrial development zones (Wilayah Pengembangan Industri. hereinafter referred to as "WPI") within the industrial zone, namely:

① Developed Industrial Development Zone (WPIMaju, hereinafter referred to as "WPIM")

② Developing Industrial Development Zone (WPIBerkembang, hereinafter referred to as "WPIB"

③ Level 1 Potential Industrial Development Zone (WPIPotensiall, hereinafter referred to as "WPIPI")

④ Level 2 Potential Industrial Development Zone (WPIPotensialⅡ, hereinafter referred to as "WPIPI")

The following are the tax incentives applicable to each industrial zone:

A. WPIM can choose two forms of income tax incentives: corporate income tax reduction or tax allowance;

B. The validity period of import tax exemption varies according to the different classifications of industrial zones and the business cycle of the relevant taxpayers, such as: construction or development period.

Based on the relaxation of import restrictions to promote the "Commodity Complete Export Program" (Kemudahan Import Tujuan Ekspor, hereinafter referred to as "KITE"), the preferential policies implemented are as follows:

① DKITE tax exemption regulations

This tax incentive is for the business behavior of exporting finished products. Most raw materials and samples imported for the manufacture of finished products are exempt from import duties, value-added tax and luxury goods sales tax. Small and medium-sized enterprises can enjoy further preferential policies, that is, the import of raw materials, samples and machinery is also exempt from import duties, value-added tax or luxury goods sales tax, and the application requirements are more relaxed.

② KITE tax refund regulations

Taxpayers who import raw materials for the manufacture of finished products that are subsequently exported can apply for a refund of the raw materials import duties they have paid.

The next issue will continue...