This issue's introduction

Tax scope - employment income

Chapter II Individual Income Tax

Scope of taxation - employment income

Resident taxpayers are subject to income tax on their worldwide income, including capital gains.

Income refers to the amount of money you earn for consumption or to increase your wealth. Personal income includes the following categories:

1. Employment income

Includes all payments made to employees in cash which constitute taxable income to the employee. Directors' fees paid in cash and pensions are included in employment income.

①Salary

Any cash payment made by an employer to an employee is taxable income of the employee. “Worker or employee” refers to any individual who works under a labor contract, including permanent employees and temporary workers, as well as civil servants or employees of state-owned enterprises and local government-owned enterprises.

② Welfare in kind

A. Medical expenses

The hospitalization or consultation fees paid directly by the employer to the doctor or hospital on behalf of the employee are not taxable to the employee. However, if such expenses are paid directly by the employee to the doctor or hospital and reimbursed by the employer,

the cash reimbursement received by the employee should be declared for taxation.

Employee health examination fees paid regularly by the employer in accordance with the requirements of the labor law are not taxable to the employee. Employee-owned medical insurance and treatment facilities related to work-related accidents or occupational diseases are not taxable.

B. Social insurance contributions and insurance compensation

The expenses of work-related accident insurance, death insurance and health insurance borne by the employer constitute the taxable income of the employee. The pension insurance paid by the employer for the employee as a benefit shall be taxed by the employee when redeemed.

Employment insurance compensation received by employees for claims due to injury or death is not taxable. Contributions paid by employers to unapproved resident pension funds or non-resident pension funds can be deducted as expenses and reported by employees for tax purposes.

C. Transportation

According to the requirements of relevant departments or government agencies, the pick-up and drop-off services provided by employers to employees are not taxable to employees, but the commuting allowances paid to employees should be reported and taxed by employees.

D. Residence

The employer will provide free accommodation to employees in its own houses, which is not taxable to employees, but the housing allowance paid by the employer to employees in cash is taxable.

E. Wages in kind

Wages in kind (rice, etc.) are taxable, and special items and items below the threshold are not taxable.

For details, please refer to the provisions of the Ministry of Finance Regulation No. 66 of 2023 (PMK-66/2023).

F. Subsidized loans

Circular SE-16/PJ.43/1999 of the General Department of Taxation, dated April 6, 1999, provides that employees who purchase goods at a discount and receive loans at interest rates below the market level as benefits are not taxed. However, in some cases, such as when a bank provides loans to employees at a discounted rate, the employee may be taxed.

G. Club membership

Membership fees paid directly to a club by an employer on behalf of an employee are not taxable. If the membership fee is paid by the employee and then returned as a reimbursement, it is taxable to the employee.

H. Non-taxable benefits in kind

a. Meals: Meals provided to all employees at the workplace, or meal vouchers provided to employees who cannot enjoy workplace meals, the portion exceeding IDR 2 million but not exceeding IDR 2 million per person per month is not taxable, and the portion of the actual voucher value exceeding IDR 2 million after deducting the above value is taxable;

b. Benefits in kind for business in remote areas: When the employer's business premises are located in a remote area with limited economic and transportation infrastructure as determined by the Tax Bureau, the accommodation, health services, education services, religious worship services, transportation services and sports (excluding golf, motorboat racing, horse racing, paragliding or racing) benefits provided to employees are tax-free;

c. Benefits in kind provided by the employer in accordance with the requirements of relevant departments to ensure the health and safety of employees when carrying out their work: including uniforms, work safety requirements, shuttle services, crew accommodation, and benefits in kind issued in the event of an epidemic or disaster;

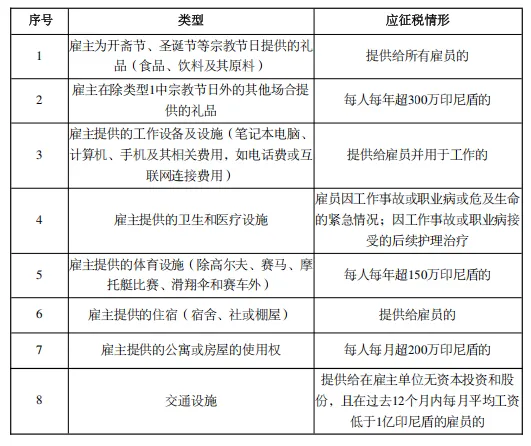

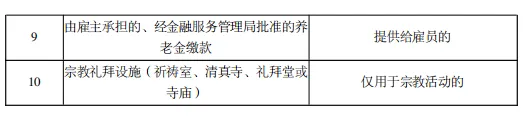

d. Other benefits in kind and taxable situations are as follows:

③ Pension income

Contributions borne by employers for work-related accident insurance, death insurance and health insurance are taxable to employees, but employer pension contributions are not taxable.

④ Directors’ remuneration

Fees and other remuneration received by resident individuals for service as members of the board of directors or other management bodies are treated as employment income and are subject to withholding tax.

⑤Others

Stock options are taxable benefits obtained by employees by virtue of their position or work. The difference between the market price and the exercise price will make the employee receive a taxable "bonus". If the employee later sells the stock

at a price higher than the purchase price, the difference should be taxed.

B. Termination pay

Compensation paid to employees in a lump sum or in installments within a maximum of 2 years due to termination of employment is subject to final tax at a rate of 5% to 25%.

The excitement continues in the next issue...